Employee ownership is an increasingly popular business structure for practices seeking sustainable growth and stability, increased employee engagement, and a sound succession planning strategy. But how does it work from a legal and financial perspective? View this webinar for an CPD session featuring Marque Lawyers Senior Associate Georgia McGrath and Atlus Financial Director Marc Walsh. Originally held 23 May 2024.

As our business landscape evolves, it becomes increasingly vital to align the interests of employees with the overall success and growth of the organisation. An Employee Share Ownership Plan (ESOP) serves as a powerful mechanism to achieve this alignment. By allowing employees to accrue a stake in the business through equity, tied directly to the company’s financial performance, ESOP fosters an environment where employees are not just workers but also stakeholders invested in the company’s prosperity.

The speakers will cover –

- How ESOPs work as a succession planning solution for businesses of all sizes

- Benefits for exiting owners

- Advantages for employees and potential buyers

- Key considerations for implementing ESOPs

- Tax benefits of different scenarios for the company and for the shareholders

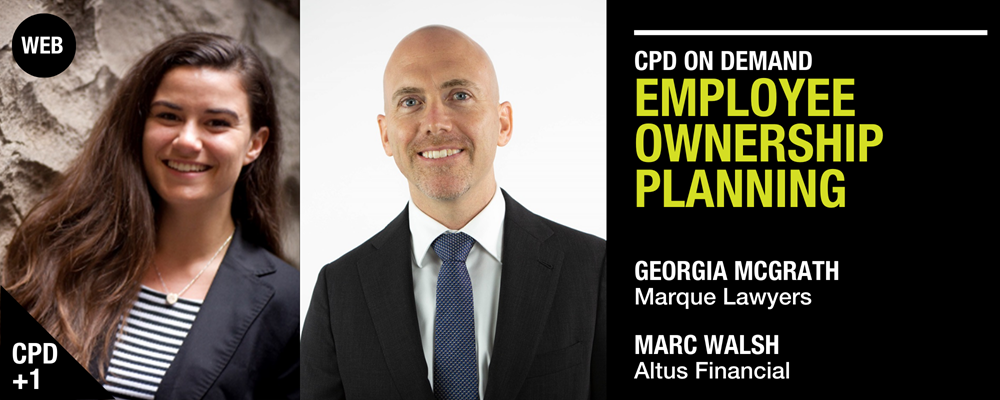

OUR SPEAKERS

Georgia McGrath is a Senior Associate at Marque Lawyers in their corporate team. She has a range of experience in assisting private and public clients with each stage of their business lifecycle, from setting up companies, to securing funding and advising on corporate transactions of all kinds. Georgia has a particular passion for helping founders to implement corporate structures that set their businesses up for success.

Marc Walsh, Director of Atlus Financial, is experienced working with clients to bring the vision and concept for businesses to life and implementing strategies and tax structures to help support this. Marc’s strengths lie in Tax, FBT, remuneration, Capital Gains Tax and establishing structures that enable clients to run their day to day operations, but also to help with their strategic and long term growth goals. A specialist tax practitioner, Marc can relay complex taxation matters in a simplistic way.

COST

Members $30

Non-members $60

*One ticket per attendee.

CPD

Completion of this 1 hour webinar and submission of answers to CPD questions will deliver 1 formal CPD point.

Learning outcomes – After completion attendees will better understand how employee share ownership works as a form of business succession planning, benefits, considerations for implementation and general tax implications for different non-specific scenarios.

NSCA 2021 Units of Competency and Performance Criteria – Practice Management and Professional Conduct - PC2

APBSA Core Area – Practice Management

Links will be provided for recording access and CPD questions. Please complete questions after viewing the webinar in its entirety. Certificates will be provided following online submission of answers to questions. Please keep your receipt, completed questions and certificate for your CPD records.